—story and photograph by Ross Courtney

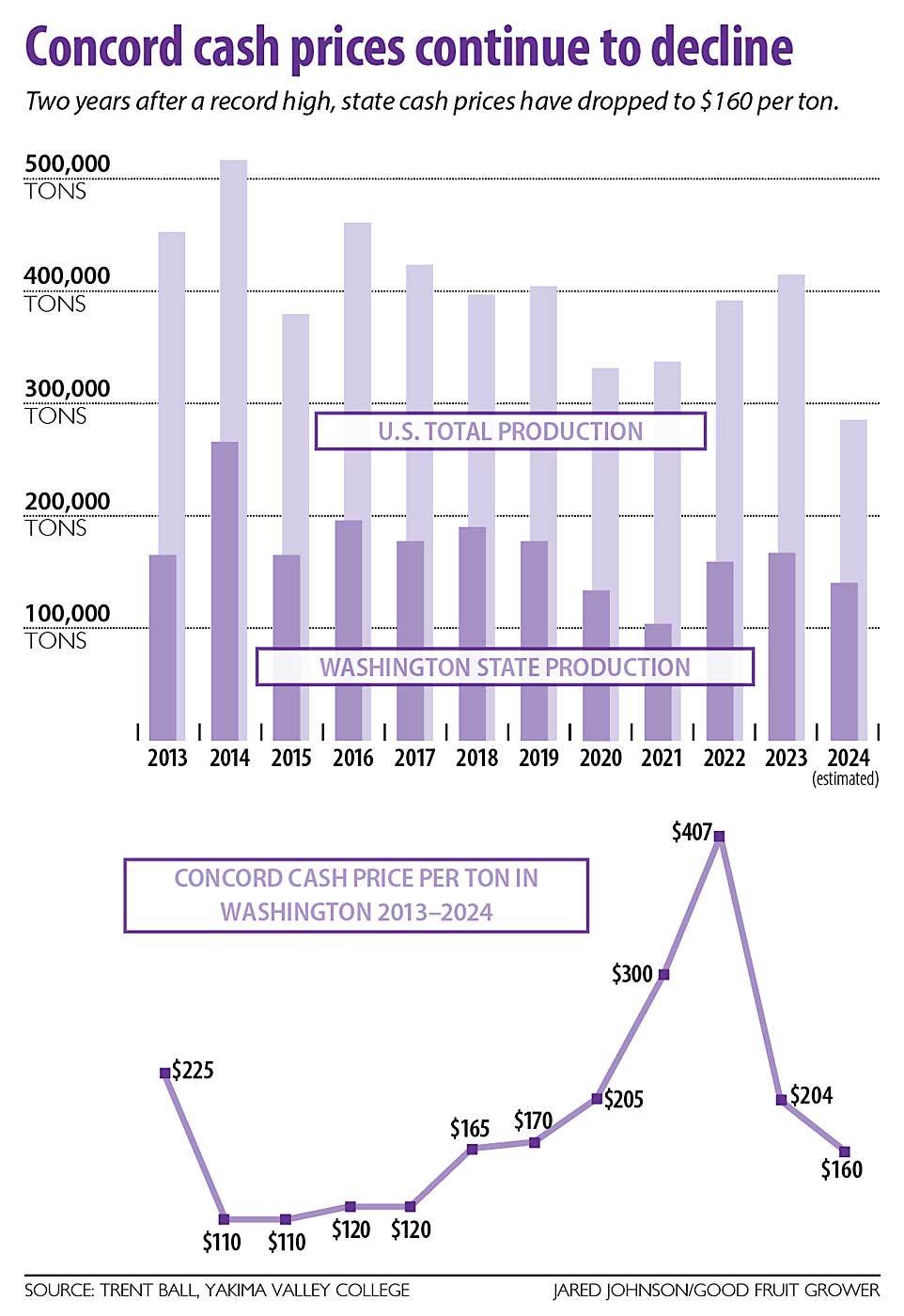

—graphic by Jared Johnson

Low juice grape costs went even decrease.

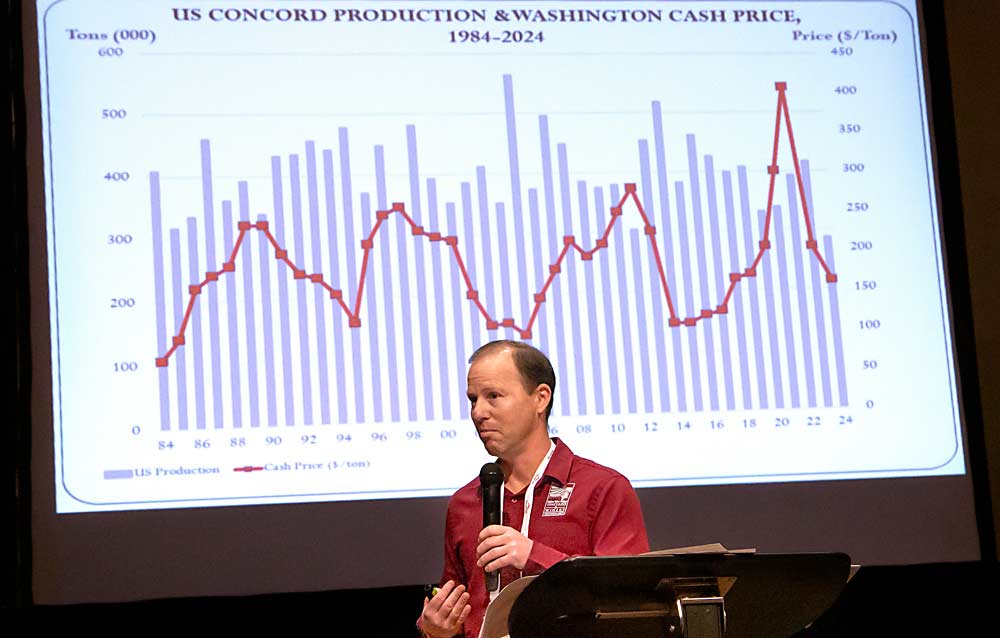

After money costs for a lot of Washington Harmony grapes plummeted in 2023, they dropped additional for the 2024 harvest, stated Trent Ball of Yakima Valley School.

“Not good; that isn’t a great graph,” stated Ball, who delivered the annual State of Grapes presentation in November on the Washington State Grape Society annual assembly in Grandview.

Washington’s weighted common money value was $160 per ton in 2024, down from $204 the earlier fall.

And similar to final yr, Ball has few explanations.

“Primarily based on the data I’ve, it’s a head-scratcher,” he stated in a follow-up interview with Good Fruit Grower.

In accordance with Ball’s calculations, Washington growers who promote to processors, fairly than these underneath contract to the Welch’s cooperative, ought to have obtained greater than $200 per ton in 2024.

Ball has compiled his trade report yearly for greater than 20 years, based mostly on communication with growers and processors. They don’t inform him the whole lot, after all. It’s potential processors doubt the standard of the focus they’ve in stock or have misplaced massive patrons, he stated.

Additionally, that money value doesn’t embrace the contract costs paid by the nation’s largest juice grape processor, the Nationwide Grape Cooperative Affiliation, which markets the Welch’s model.

Welch’s growers reported first rate costs this yr, “within the $400 vary” for grapes, stated Carter Kilian, a Sunnyside grower. Kilian, a Washington State Grape Society board member, has some acreage contracted for Welch’s and a few that he sells to the J.M. Smucker Co.

Smucker’s dropped its value from $380 per ton for 2023’s crop to solely $170 this yr, stated Grandview grower David Golladay.

“Simply because they’ll,” Golladay stated.

That’s about 60 p.c of his price of manufacturing, he stated.

The value was an excellent greater shock as a result of the corporate informed growers in late 2023 it wanted extra grape quantity to maintain up with demand for its merchandise, primarily Uncrustables, Golladay stated. The J.M. Smucker Co. expects the frozen, prepackaged, crustless peanut butter and jelly sandwiches to surpass $1 billion in gross sales by 2026, after building of a 900,000-square-foot manufacturing facility in Alabama, based on a current information launch from the corporate that owns the Smucker’s model. Up till 2023, processor costs lined up carefully with one another, Ball stated.

Provide and demand shed no gentle on the worth surprises.

Washington and the Japanese U.S. manufacturing areas each harvested volumes effectively beneath their respective 10-year averages. Washington introduced in 138,000 tons, in comparison with a 10-year common of 172,000. The Japanese area additionally collected about 138,000 tons, in comparison with its 197,000-ton common.

Manufacturing areas started eradicating acreage about 10 years in the past, as a response to low costs, although Washington’s harvested acreage inched up simply barely in 2024.

The value hole between East and West money costs was practically $200 per ton for 2024. The East usually sees greater costs, however solely by about $30 to $50 per ton, Ball stated.

“It’s an enormous stratification,” Ball stated.

Smucker’s didn’t reply to messages from Good Fruit Grower. Neither did Milne Fruit and Fruit Sensible, the opposite two processors who buy Washington Concords.

Focus costs, which gasoline grape money costs, don’t clarify a lot both. Washington obtained about $15 per gallon of focus, Japanese growers about $17. These aren’t file costs, however they’re above common.

Ball was uncertain what the long run would convey.

“What’s money value going to do? I don’t know,” Ball stated. “It ought to have gone up.” •