Seasonality

The concept that a selected crop — in our case, espresso — is on the market and recent for a selected portion of the 12 months is long-ingrained within the specialty meals and beverage industries.

Like all different fruit, espresso berries have a finite shelf life. But whereas most drupes are coveted primarily for his or her fleshy pulp, espresso is coveted for its seeds. Subsequently, a inexperienced espresso’s freshness is expounded not solely to its harvest time, but additionally to the time required for processing (i.e., eradicating the seeds from the fruits and making ready them for storage and transit), the time related to worldwide delivery, and the elongated (however not infinite) time spent in a warehouse or roastery, ready to be roasted whereas nonetheless recent.

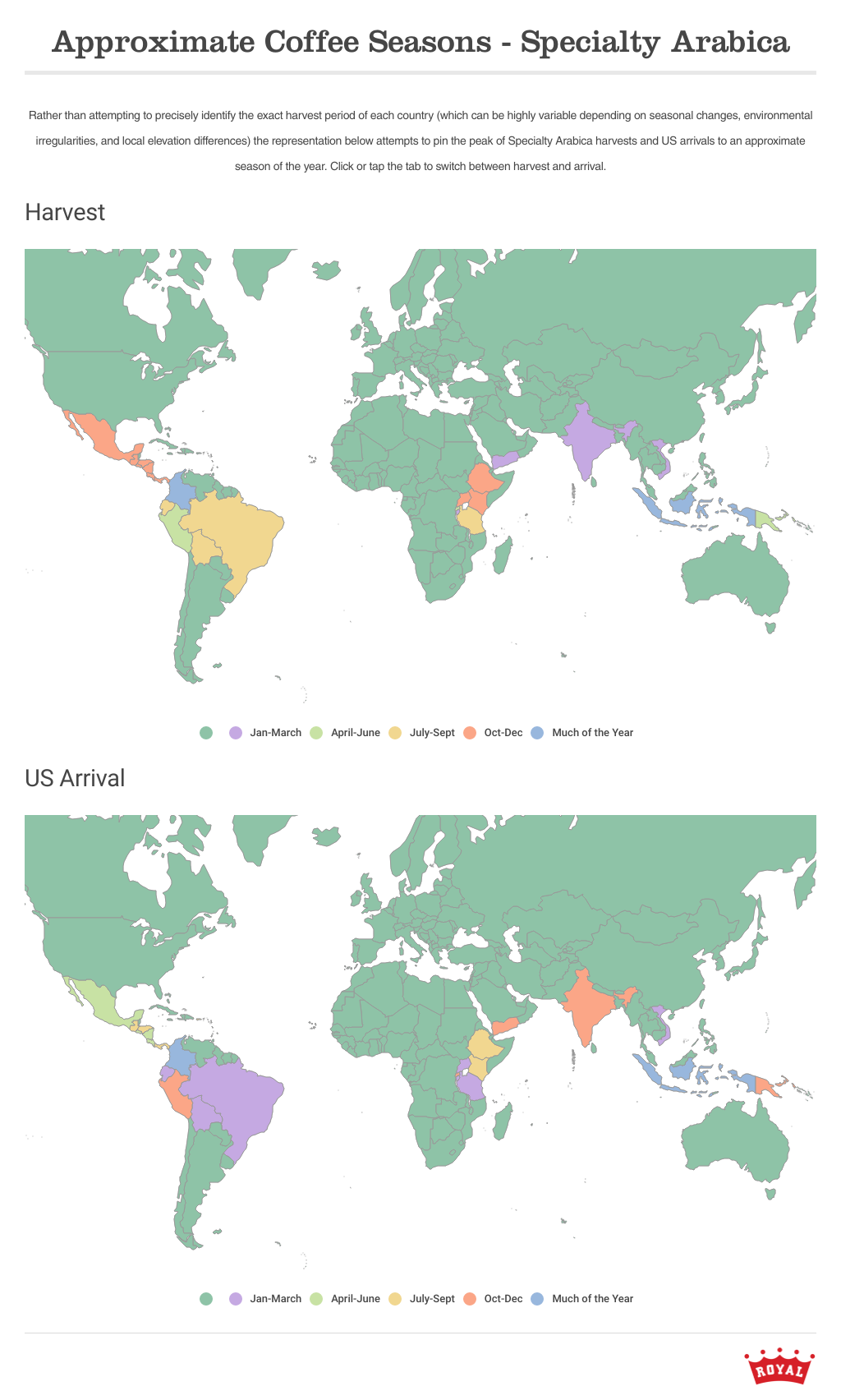

Six years and what looks like a lifetime in the past, I penned a piece for DCN that tried to elucidate and visualize typical vacation spot arrival time frames from many espresso areas on this planet. I even copied and pasted a big part of the article into my Inexperienced Espresso guide.

Immediately, the entire thing is beginning to look a bit incorrect to me. So what occurred between then and now? The brief reply is: the whole lot.

What’s Modified?

In no explicit order, there was an unprecedented world pandemic, ongoing shifts in world temperatures and local weather extensively acknowledged to be attributable to human exercise, and a number of dire humanitarian crises, not the least of which is an ongoing genocide in Gaza and broader violence throughout the Center East.

Every of those phenomena impacts us deeply as a human species way more deeply than they have an effect on espresso, and I can’t let you know what number of occasions in the previous couple of years I’ve needed to pause, breathe and remind myself that what I do in espresso issues little in a world that feels continually set to flame. I can’t say what number of occasions I’ve stopped in the midst of an editorial about espresso, seemed round and never typed one other phrase.

But one of many throughlines contemplating these phenomena is that what impacts certainly one of us impacts us all. With that in thoughts, I do nonetheless wish to speak about espresso, and the way the world altering round us has altered the product we love.

Local weather

Nowhere can the consequences of local weather be felt extra acutely by espresso merchants than within the C Market. Usually, world costs spike in September, as sizzling, dry climate hints that Brazilian coffeelands could also be affected by drought. Then, someday in October, finally it rains, and the market relaxes.

This is not going to all the time be the case. The fluctuations of 2024’s have been magnified by dangerous climate in Vietnam. The worldwide robusta market was so closely bent by projected provide shortages that the value of arabica rose in parallel. We’ll see this, and phenomena prefer it, once more.

One 12 months, most likely not thus far sooner or later, the rains will fail. Later, drought might grow to be the norm. The quickly altering local weather and the failing of the earth’s carbon sinks bode ominously for a local weather future during which politicians and trade barons alike appear unwilling to bend to new planetary realities.

For many people within the behavior of shopping for espresso, climate-related points are inclined to hit hardest within the pockets. But for these rising, harvesting, and processing the crop, local weather’s influence could be all-encompassing. As soon as extra, for these within the again: The consequences of local weather change most closely influence those that are least chargeable for its causes.

Not solely should the farmer in Brazil, Vietnam, or elsewhere climate the fallout from decreased yields, they need to additionally survive in an more and more difficult and unpredictable bodily setting. Moral patrons ought to perceive that the price of their espresso should embrace concerns for adaptation for each espresso crops and their human custodians, and may strain industries like petroleum, delivery and packaging for really sustainable options to the issues they’ve began.

We’ve not but totally felt a seismic shift in volumes and seasonality of espresso associated to local weather change. Nevertheless, some cracks are starting to indicate, if you realize the place to look. One huge one is related to the price of espresso — typically associated to rain, drought or frost affecting its future availability. Based mostly on commodity costs, massive, subtle merchants might choose to carry or launch substantial volumes of espresso, affecting seasonality downstream.

Logistics

Provide chain delays grew to become each day information fodder in 2020, and whereas there’s been a restoration of quantity capability at ports worldwide, small anomalies in availability of containers in sure ports can influence timelines way over what we’d as soon as anticipated.

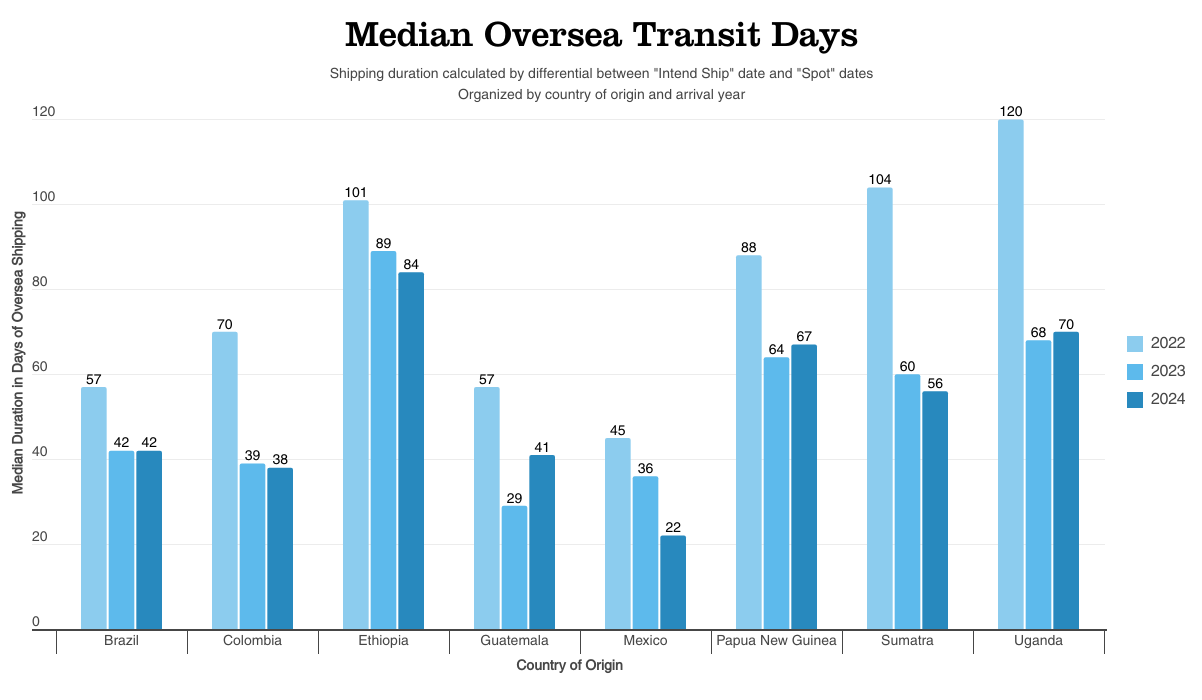

2022 will stay a 12 months of infamy for espresso importers, as most had been closely impacted by delivery delays as future demand outpaced spot provide. Over-purchasing briefly grew to become the norm as patrons scrambled to purchase any espresso accessible at any price. Weeks turned to months as labor and container shortages introduced worldwide delivery traces to their knees. We noticed some coffees spend greater than six months or extra on the water.

As coffees arrived, early 2023 grew to become a nightmare state of affairs for anybody who was on a shopping for spree in 2022. Rates of interest skyrocketed inflicting spikes within the value of financing massive portions of espresso, and 2023’s crop grew to become cheaper and extra available — and extra engaging to savvy patrons — than the growing old shares of 2022, which had been left to wither and devalue in warehouses the world over.

Most inexperienced espresso merchants slashed their 2023 buying volumes to compensate, hoping to maneuver stock from their warehouses bulging with older coffees. Some, small and huge, didn’t survive, and the import trade consolidated.

Consolidation within the delivery trade additionally exacerbated provide snarls, as we noticed markedly in Ethiopia this 12 months. Within the spring of 2024, after months of Israel’s catastrophic and disproportionate violence within the Gaza strip in retaliation for Hamas’ assault on October 7 of 2023, Yemen undertook a Palestinian solidarity marketing campaign, disrupting delivery lanes by means of the Pink Sea by firing missiles at container vessels.

In March, Maersk ended port calls, and the opposite main delivery line, run by MSC, picked up the slack. Inner estimates at Royal put the share of espresso exported from Djibouti by MSC at round 80% of complete quantity, a digital monopoly. This solely lasted till late June, when MSC introduced that service calls would finish to and from the port, amid the height of the Ethiopian espresso export season. This successfully suspended service from the only port of debarkation for one of many world’s preeminent espresso suppliers.

The state of affairs within the Pink Sea is much less dire now than it was then, though the relative stability has taken a human toll within the type of indiscriminate bombing of Yemen by U.S. and UK forces. For anybody with the luxurious of a ten,000-foot view, the price of delivery Ethiopian coffees this 12 months, as measured in human lives, has been troublesome to abdomen.

Case Research

Ethiopia has been one thing of a bellwether for lots of the considerations talked about above, but it has additionally been an instance of international investments and foreign money alternate impacting the costs and availability of espresso.

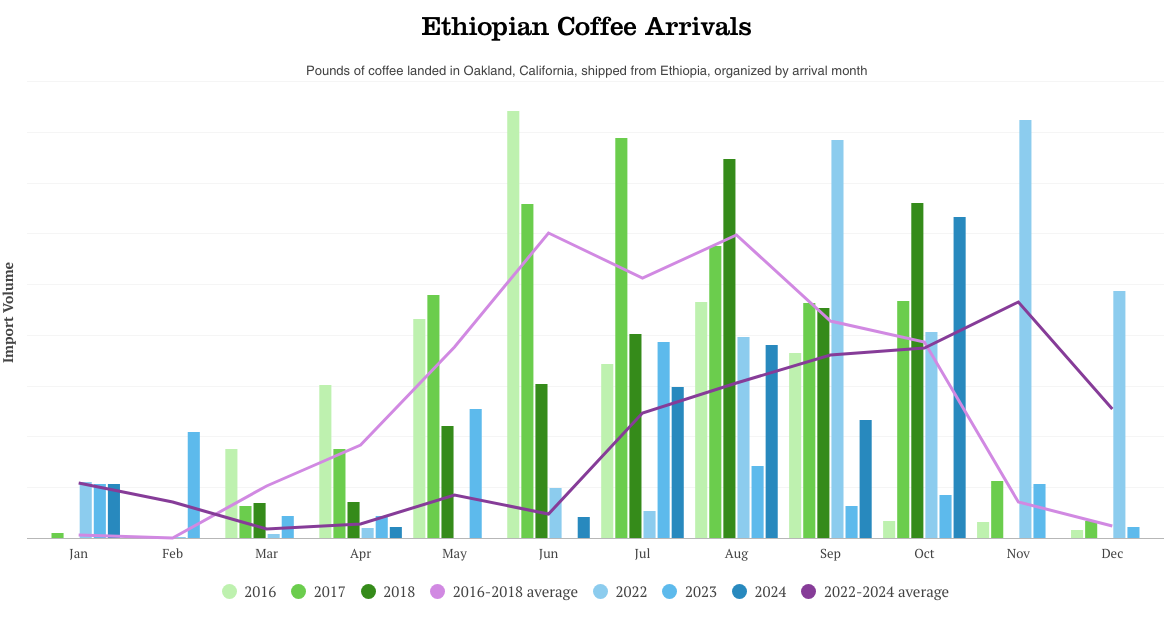

Pre-pandemic, Ethiopian arrival volumes to the U.S. had already been shifting, with espresso devanning in Royal’s warehouses almost a month later in 2018 in comparison with 2016. On the time of the prior article’s publication, this was primarily blamed on remoted local weather circumstances.

In 2022, Royal Espresso’s substantial arrival volumes peaked later within the calendar 12 months than we’d ever seen, with huge bag counts touchdown as late as November and December, and some ill-fated containers displaying up as late as February 2023.

This 12 months, as we resumed larger quantity purchases after clearing 2022’s shares, Royal managed to land a few decrease grade coffees in Oakland as early as April, although the majority of our high tier purchases had been impacted by the Pink Sea fiasco and largely arrived in late September and October.

I’m undecided we’ll ever return to the softer occasions of the 2010s, when June was a standard expectation for peak seasonal Ethiopian arrivals. Since 2022, oversea transit occasions have solely marginally improved when shipped from Djibouti, not like different frequent ports of debarkation.

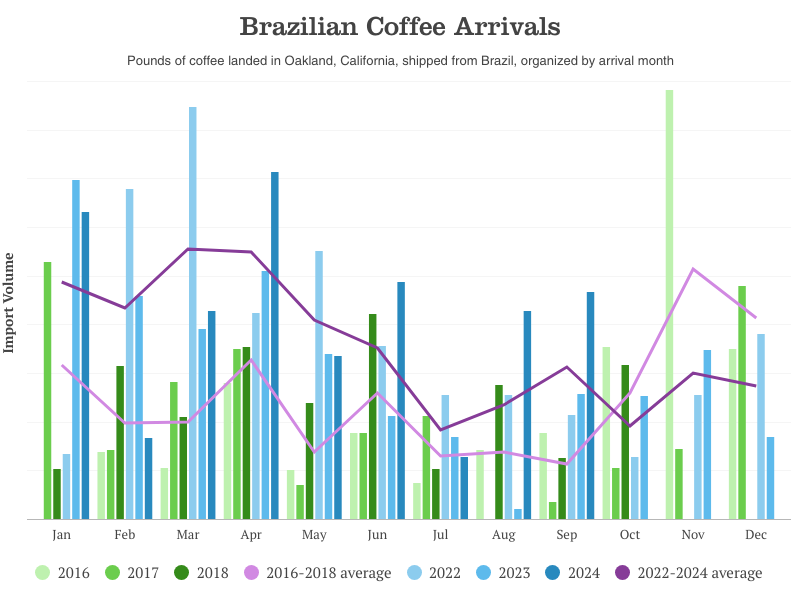

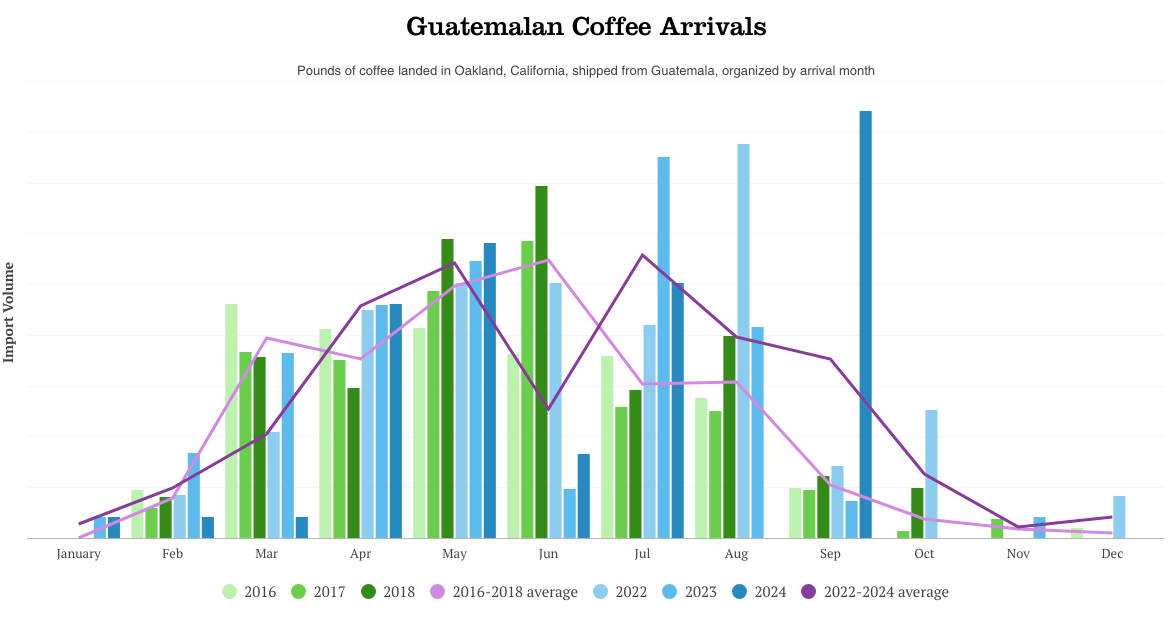

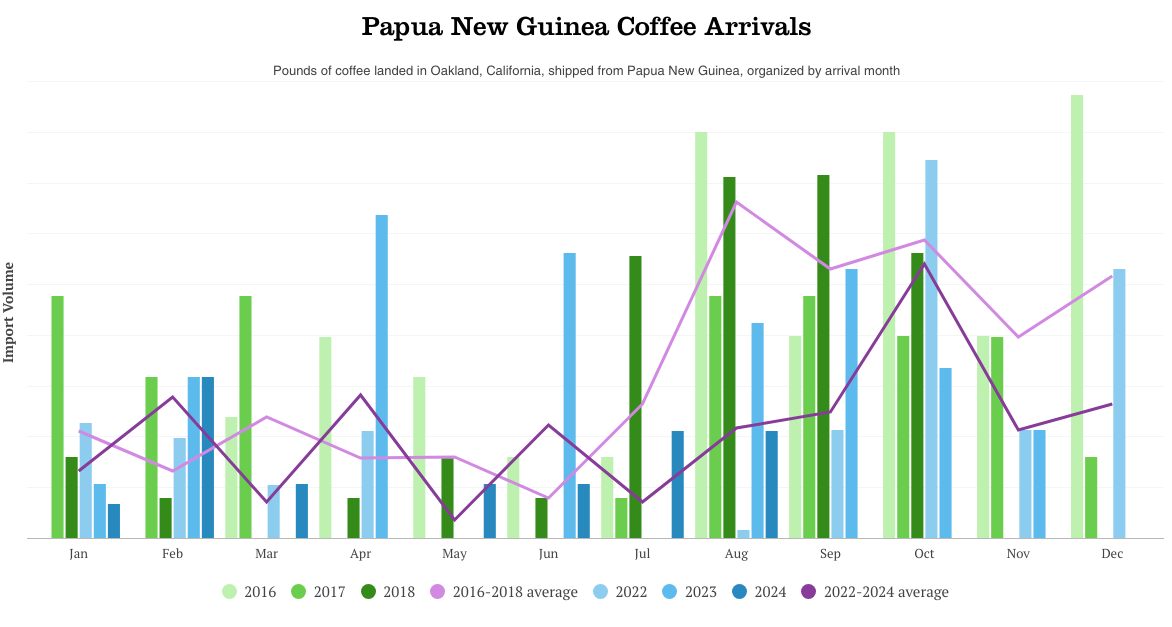

Different espresso producing nations with statistically vital volumes — and with which I had knowledge to match from 2018’s report — comply with this total delayed arrival pattern in Royal Espresso’s imports, together with Brazil, Guatemala, and Papua New Guinea.

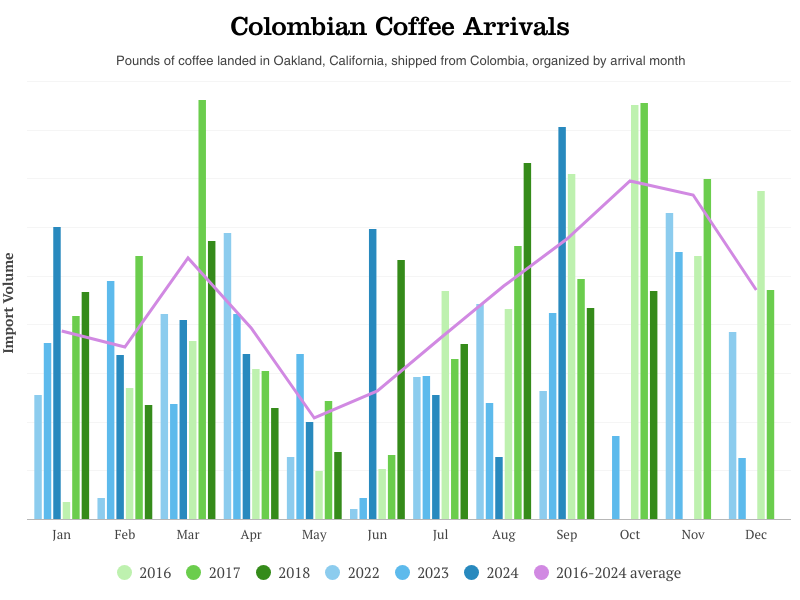

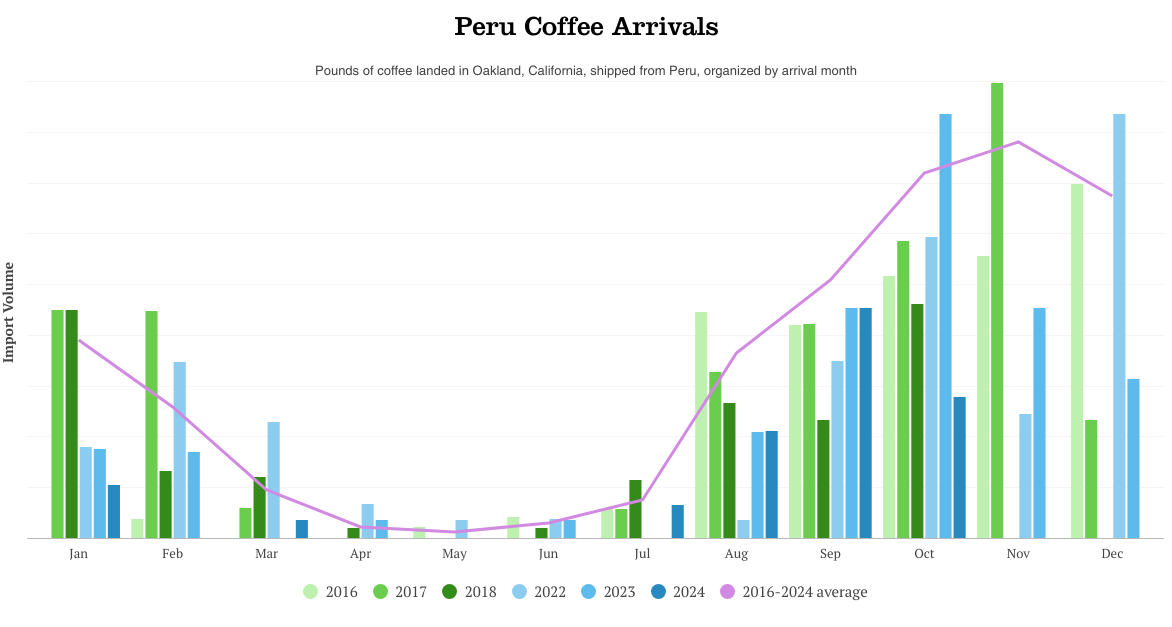

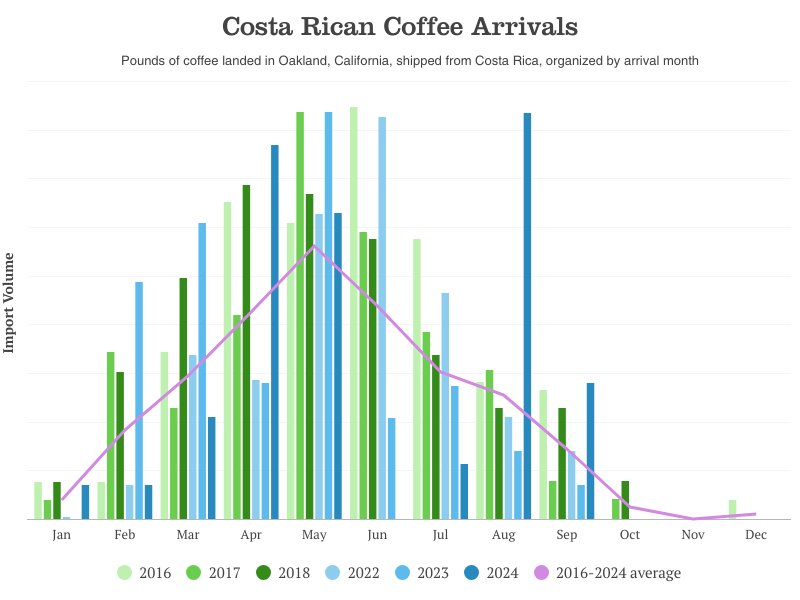

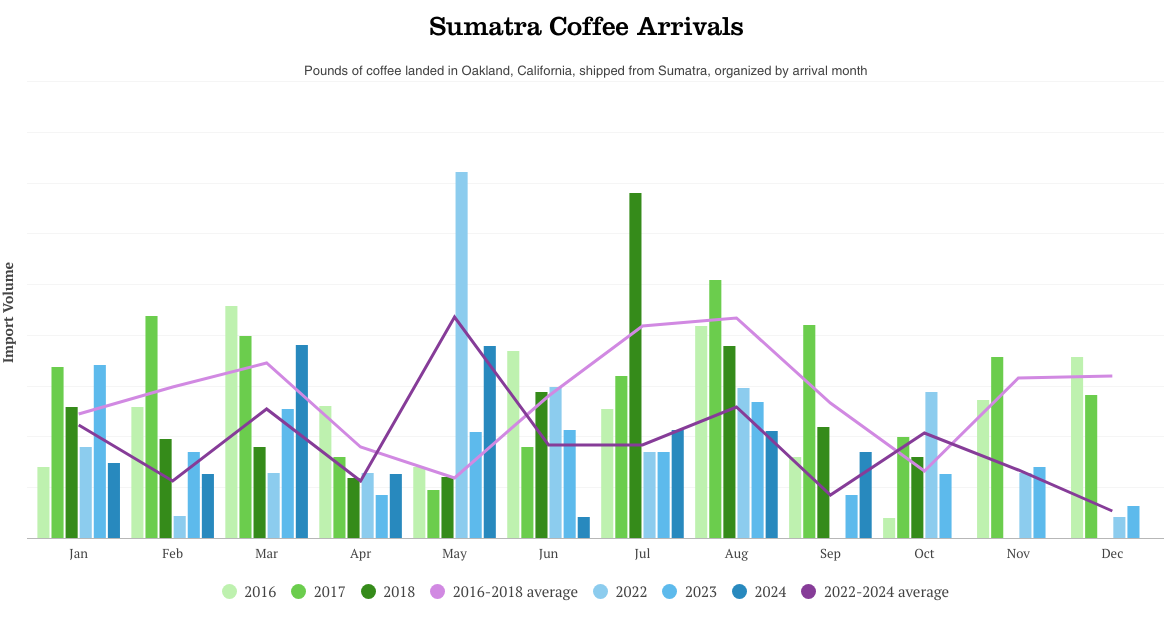

Costa Rica and Peru, nonetheless, appear considerably unaffected. Sumatra and Colombia each seem to indicate seasonal shifts that defy expectation. With espresso accessible from each Indonesia and Colombia for a lot of the 12 months, it’s probably probably the most accountable rationalization for these shifts is just associated to adjustments in our purchasing habits moderately than harvest, availability or delivery delays.

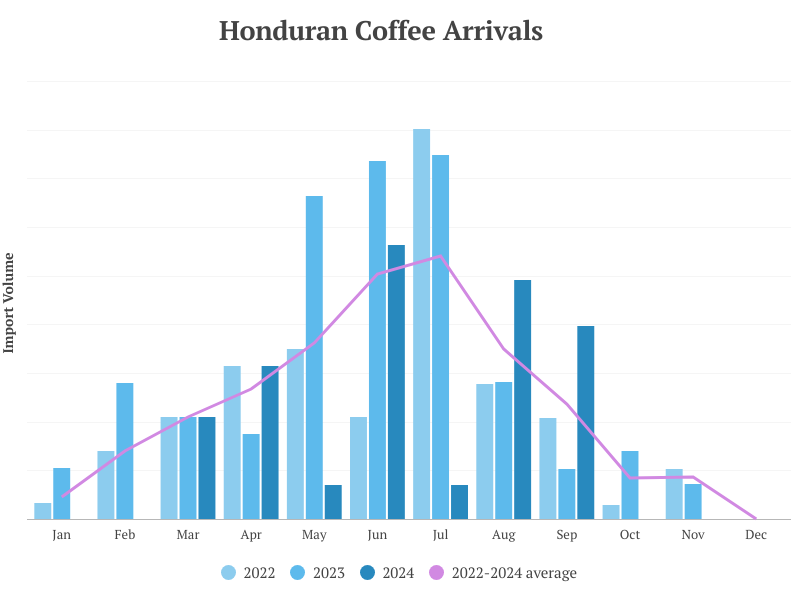

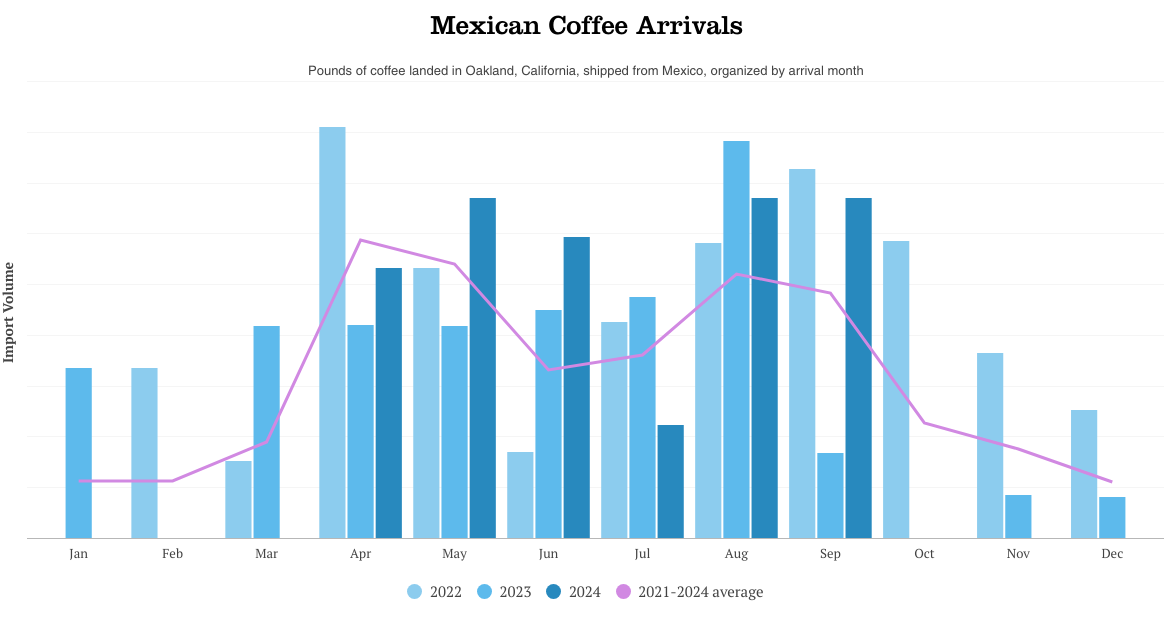

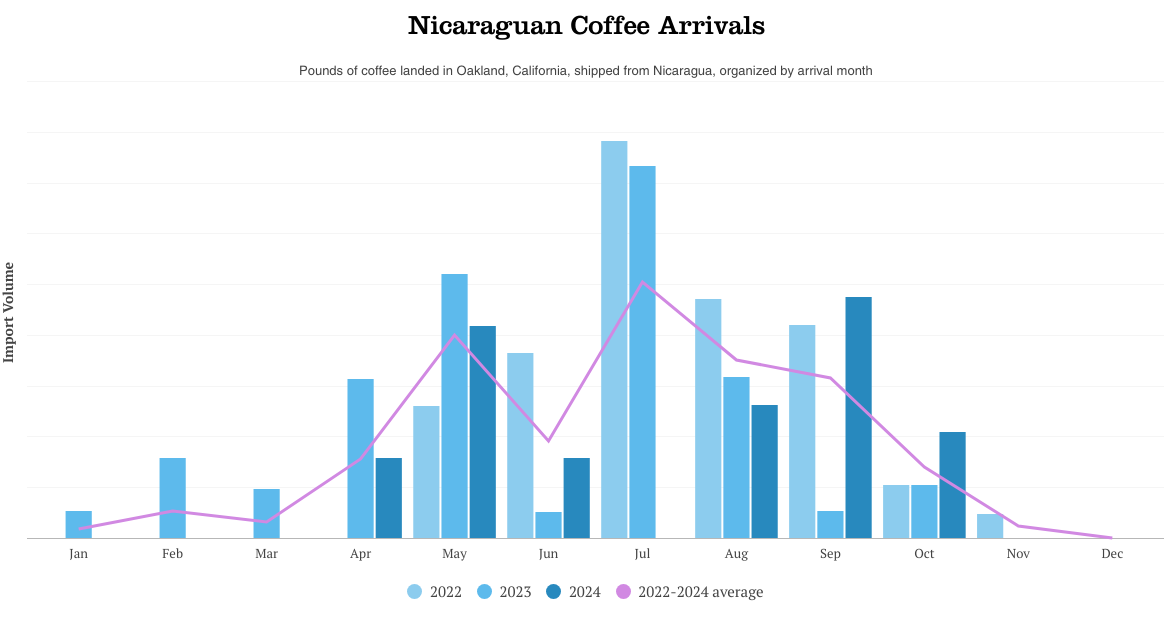

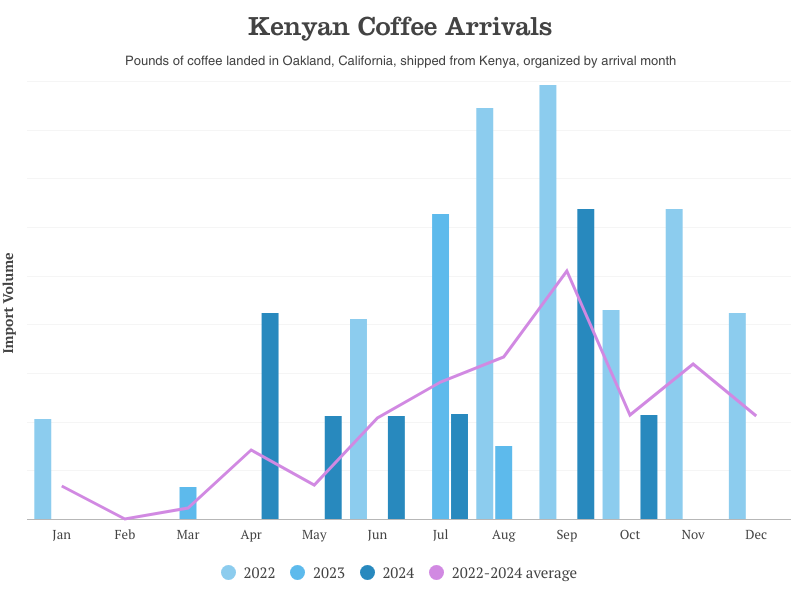

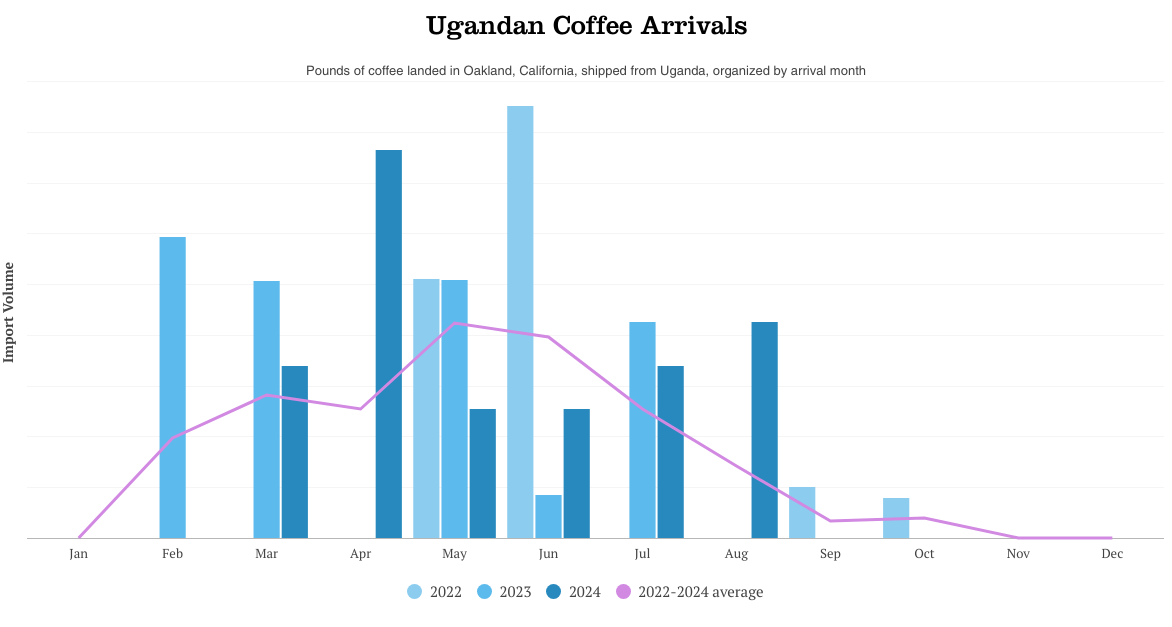

I’ve included some datasets from coffees that weren’t a part of the 2018 survey, as effectively, which largely show latest developments in arrivals. Once more, these are restricted to the coffees Royal Espresso has imported particularly to our warehouse right here in Oakland, California, and are thus not essentially reflective of transit occasions and arrivals in different areas of the world.

Subjective Seasonality

Seasonality, I’ve come to imagine, is as a lot within the eye of the beholder as it’s the results of some other advanced or situational circumstances. Espresso harvest durations in a lot of the world can final for weeks, if not months, and drift based mostly on regional local weather shifts, labor availability and different forces.

Export and import could also be expedited or delayed for myriad causes, not the least of that are macroeconomic and socio-political in nature, and never essentially associated to espresso itself.

Inasmuch as espresso freshness stays a subject on the tongues of specialty espresso professionals, so too should the bigger machinations of local weather, geopolitics, economics and, I’d argue, fairness and empathy.

As an trade, and as a set of individuals on a sophisticated planet in unprecedented occasions, we might have to discover new and nuanced approaches to espresso freshness and seasonality.

Listed here are some extra country-specific arrivals schedules:

[Publisher’s note: Daily Coffee News does not engage in sponsored content of any kind. All views or opinions expressed in this piece are those of the author/s, and not of Royal Coffee or Daily Coffee News.]

Chris Kornman

Chris Kornman is a espresso romantic and educator, and a high quality specialist with a historical past of indiscreet espresso shopping for, roaster fires, ill-advised journey, and oversharing. He’s the writer of Inexperienced Espresso: A Information for Roasters and Patrons and often contributes coffee-related disquisitions to publications worldwide.