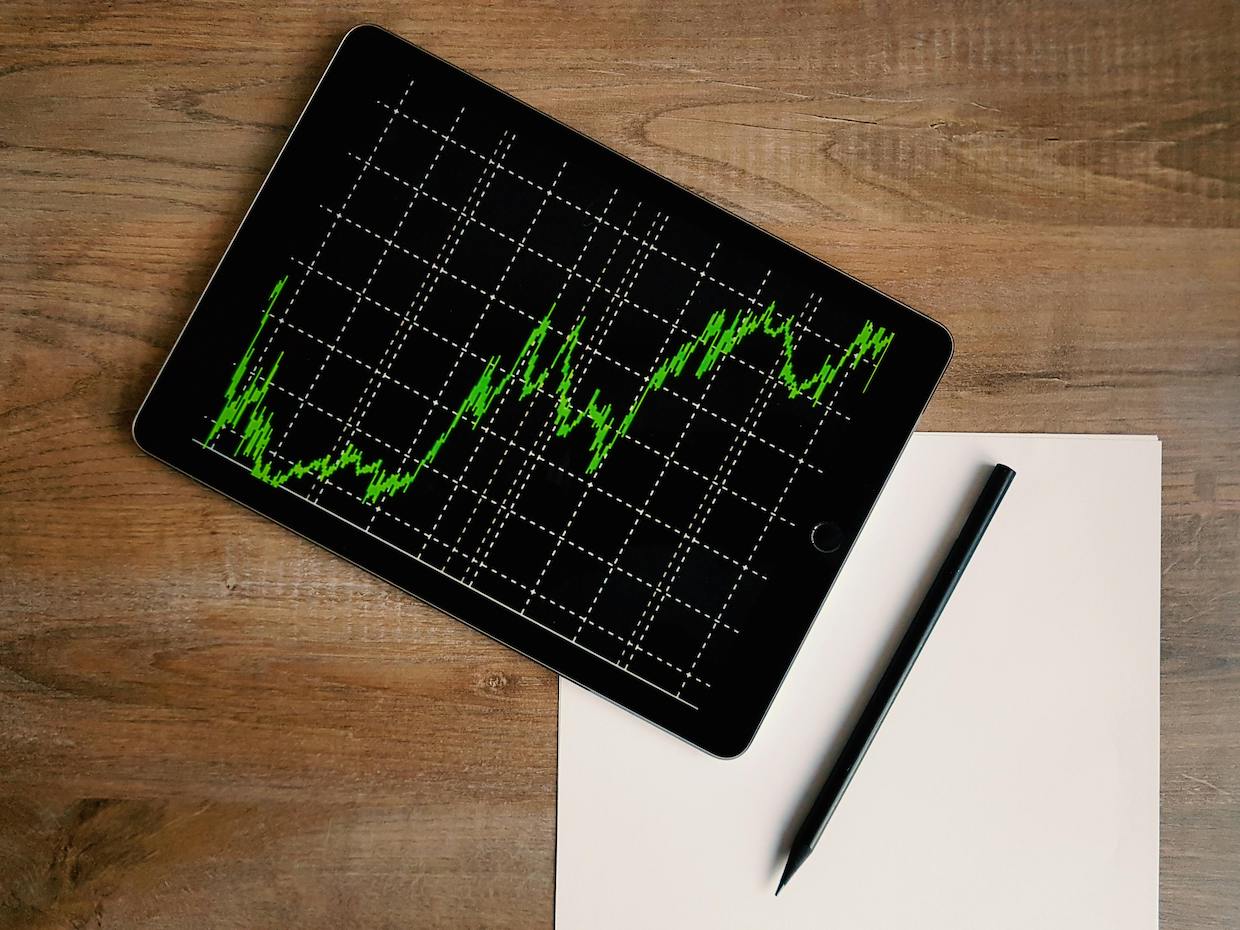

Espresso Costs – 45 Yr Historic Chart. Supply: Macrotrends.

Dutch inexperienced espresso dealer Sucden Espresso agreed to a settlement with the Intercontinental Trade (ICE) following a discover that it “could have” violated a rule designed to forestall espresso market manipulation.

Sucden Espresso Netherlands B.V., a part of the mushy commodities buying and selling firm Sucden, agreed to pay a $20,000 effective whereas surrendering greater than $670,000 in earnings gained from the alleged guidelines violation.

Sucden neither admitted nor denied wrongdoing, based on the settlement.

Based on a broadcast disciplinary discover from ICE — the for-profit publicly traded firm that operates the ICE espresso futures market, a.okay.a. arabica “C market” — Sucden Espresso was present in potential violation of change rule Rule 6.18(b).

The rule prevents people from holding greater than 500 futures contracts in a single route — both shopping for or promoting — for months when supply notices are issued. The rule is meant to forestall corners, squeezes and different types of market manipulation. It’s additionally designed to forestall particular person market members from excessively influencing the market.

Sucden didn’t instantly reply to requests for remark relating to the ICE settlement.

The ICE reached a settlement following comparable allegations towards espresso dealer Olam Worldwide final yr. In that deal, Olam agreed to pay a $30,000 effective and give up earnings of greater than $430,000. As a part of that settlement, Olam additionally didn’t admit nor deny wrongdoing.

Feedback? Questions? Information to share? Contact DCN’s editors right here.

Associated Posts

Nick Brown

Nick Brown is the editor of Every day Espresso Information by Roast Journal.